Economic Update October 2025

- Dr Roelof Botha

- Nov 8, 2025

- 3 min read

Updated: Dec 3, 2025

The downside

The proceedings of the Judicial Commission of Inquiry into Criminality, Political Interference, and Corruption in the Criminal Justice System, more commonly known as the Madlanga Commission, read like a horror story. To the extent that there is any truth in the revelations by the head of the country's crime intcountry's that sophisticated, organised criminal entities have infiltrated the state's crime prevestate'spparatus, immediate and comprehensive measures will be required to halt the decline in the country's police secountry'sless the public can be convinced that the Madlanga Commission will ultimately lead to the removal from office of persons found guilty of apparent state capture by violent criminal networks, South Africa stands to lose intellectual capital in the form of the emigration of highly skilled individuals, who are always in demand around the globe.

On the economic front, the fact that capacity utilisation in manufacturing remained lower in August 2025 than a year ago is a testament to the ongoing oversight by the Monetary Policy Committee (MPC) of the plight of South Africa's manufacturing sector. In August, manufacturing output was more than 9% lower than in August 2019 (pre-COVID), primarily due to weak demand and an overvalued currency, which makes imported manufactured products relatively cheaper than local products. Lowering interest rates is the obvious remedy, but the MPC appears blissfully unaware of the damage it continues to inflict on the economy through its overly restrictive monetary policy.

The upside

Retail trade continues impressive rise.

Amid lethargic growth in the manufacturing and wholesale sectors, consumers are doing the economy a big favour by returning to shops in large numbers, posting a real year-on-year increase in sales of almost 4% during the second quarter of 2025. In value terms, South African shoppers spent a whopping R972 billion between January and August, with the four-quarter average reaching a record high of R380 billion.

The recent spike has positively influenced the latest data on bumper retail trade sales, as indicated by long-term insurance surrenders and lump-sum pension payments. These increases have resulted from the so-called two-pot retirement system, which began in the third quarter of 2024 and has led to a significant rise in retirement fund withdrawals. There is little doubt about the positive impact of these withdrawals on retail trade sales.

According to data compiled by BetterBond, the average real salary of homebuyers has increased at a healthy rate over the past four years, with total household income averaging R90,000 per month. This trend has also contributed to the recovery of retail trade sales.

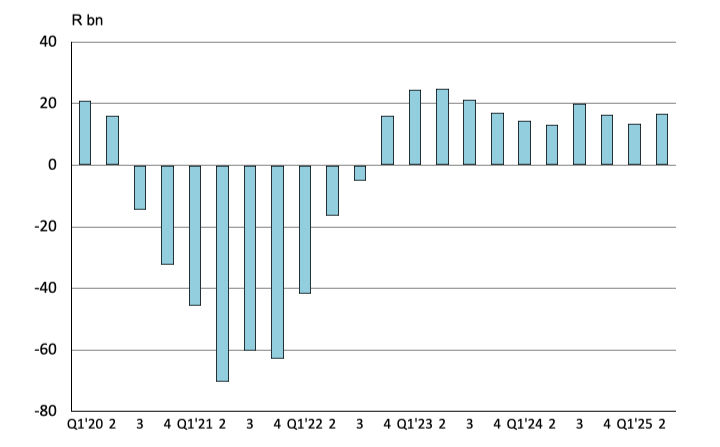

The financial account of the Balance of Payments is in good shape.

According to the Banking Association of South Africa, South Africa's removal from Africa's grey list of the Financial Action Task Force (FATF) at the end of October could improve investor confidence. It also serves as proof that the government of national unity (GNU) can deliver results in tackling the scourge of corruption that became evident during the era of state capture.

The robust performance of the financial account in the balance payments since 2023 suggests that capital markets have consistently been comfortable with SoBalanceica's ability to address the legislative deficiencies identified by the FATF. A nod of approval was also received from capital markets, with South Africa's ten-year bond continuing its downward trend and the rand having strengthened by more than 9% against the US dollar since the beginning of the year (as of 31 October).

Credit rating upgrade on the cards

Speculation is rife that South African bonds may soon receive a credit rating upgrade, as noted in a Bank of America note citing S&P Global Ratings' current positive outlook for South Africa's local currency (albeit still at a sub-investment-grade level). The following overview of South Africa's macroeconomic outlook from the ratings agency is likely to be influenced by strong growth prospects for 2025 and 2026, significant increases in precious metal prices, and improvements in harbour efficiency. The removal from the FATF grey list and signs that the coalition government is starting to implement economic and fiscal reforms, whilst also improving the country's logistics, play a role in S&P Global's decision.

On Balance, by Dr Roelof Botha, deliberately emphasises positive news, often highlighting the African economy's Balance and the immense scope for new business opportunities.

Comments